(This article was first published on Kyle Harrison’s blog.)

Investing, in simplest terms, is taking one finite resource and trying to allocate it to maximize for an ideal outcome. Whether you’re allocating money, time, energy, or attention. Everyone is an allocator of something. Investing is an opportunity to evaluate what you believe. To gain conviction. And then to act on that conviction.

I love investing because I love ideas. People sometimes talk about ideas as being “a dime a dozen.” The limitation on any idea is the infrastructure that lets it expand. The processes I’ve laid out here are some of the ways I try to let my ideas survive for as long as possible and expand as much as possible before investing behind them.

Investing 101 2.0 is my occasional home for reflecting on all things investing. The overall theme here is one of first-principles: Learning the fundamentals of investing (101) while looking for the ways it’s being reinvented (2.0). This article is super long, but it reads more like an evergreen reference guide you can return to over time as different tools become relevant to you.

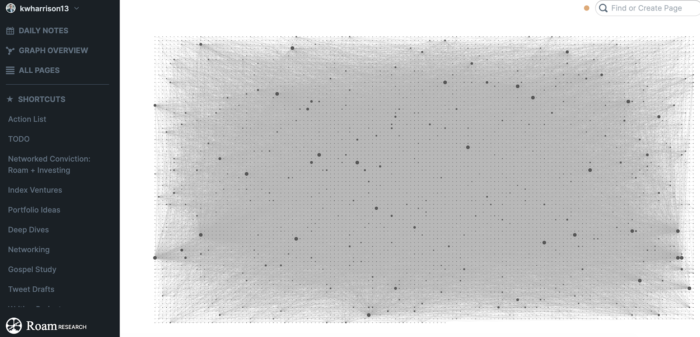

We’ll start by laying out my thoughts on investment research. I invest in companies, whether early stage, late stage, or public, and out of my own pocket or with other people’s money. However, the process I use is consistent. I use a specific tool (Roam Research) to collect ideas, question them, find companies around those ideas, and ask the same sets of questions. And then I share what I learn. You can also find a Roam version of all these tools and templates in the Investing 101 2.0 Sandbox.

What is Roam?

If you’re already a Roam ninja you can skip to the next section. Let’s go over the basic building blocks I use every day within Roam. I have done what I call a #RoamTour 100 times now where I talk through these basics with people, and my preface is this: “I’m a 2 out of 10 in Roam mastery, so this is just to show you what you can accomplish even without much skill.” Conor White-Sullivan, the founder of Roam, describes the product as “low floor, high ceiling.”

There are several in-depth overviews of Roam out there, both in terms of the product features and the grand vision of what Roam could be as a product. And there are great resources to teach you everything you need to know about being a Roam power user. My path to learning was literally just scrolling through #RoamCult and @RoamResearch mentions on Twitter. This overview will be simpler to ensure everyone is at the same starting point.

In case videos are more your style, I’ve included some guided videos throughout the article.

Pages and Blocks

The most important thing to understand about Roam is that it is a collection of pages and blocks (each individual bullet point is a block). A good analogy is to Excel. Each page is like a tab in Excel and each block is a cell. To create a page you put any word or phase in between [[double brackets]]. You can also use #Page but if it’s two words you need to use double brackets, #[[New Page]] and the # is a style choice of whether you want the link blue or faded grey. Two of the most common types of pages I use are lists like [[Investment Memo Template]] or [[Investment Frameworks]], and then company pages like [[Shopify ($SHOP)]].

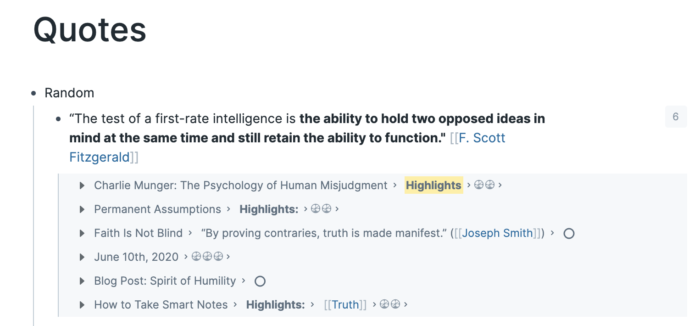

Block References

One of the superpowers of Roam is the ability to reference individual blocks in different places throughout your graph. Let’s say I have a block (a cell in Excel) with a quote from F. Scott Fitzgerald that I want to reference in a number of places. I can reference that block in any relevant page. Then, when I go back to that original block I can open it up and see all my references to that specific block.

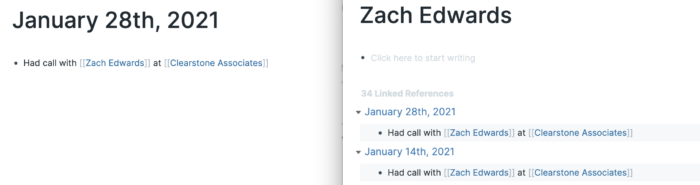

Daily Pages

This is the main screen of Roam. When you open up the program each day you see a blank daily page. You should think of this as the same as any other [[Page]], the only difference is that it is automatically generated by Roam.

I use the daily page for anything I want to be “date stamped,” like when I have a general networking call with someone and I want to remember what day I last spoke to them.

When I’m reading articles or having conversations about a specific company, I may just put those notes right on the company page if they’re going to be things I reference a lot. For more casual daily observations about a company I create a specific page like [[[[Shopify ($SHOP)]] – Daily Sentiment]] that I’ll drop on the Daily Notes page. I’ll talk more about that later.

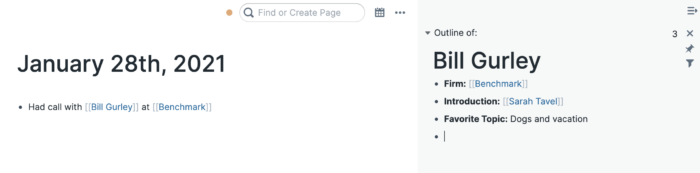

Side Bar

You can Shift + Click on a page link and open it in the sidebar. This is particularly helpful when you’re referencing one page on another so that you can see them side by side.

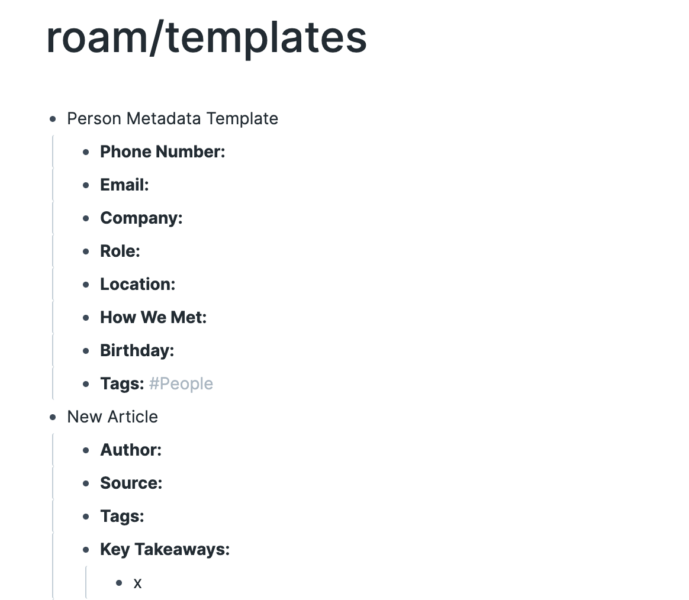

Roam Templates

If you find yourself typing something over and over again, or copying and pasting, you can create a Roam template. First, you create a page called #roam/templates. On that page every main block you make will become the title of a template and whatever you put underneath that block will become the template.

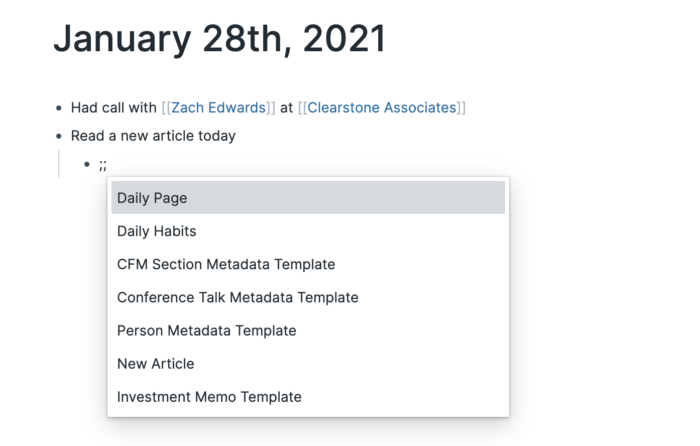

You can bring up the template options on any page just by typing “;;” and then selecting from your options. The template will automatically populate from there.

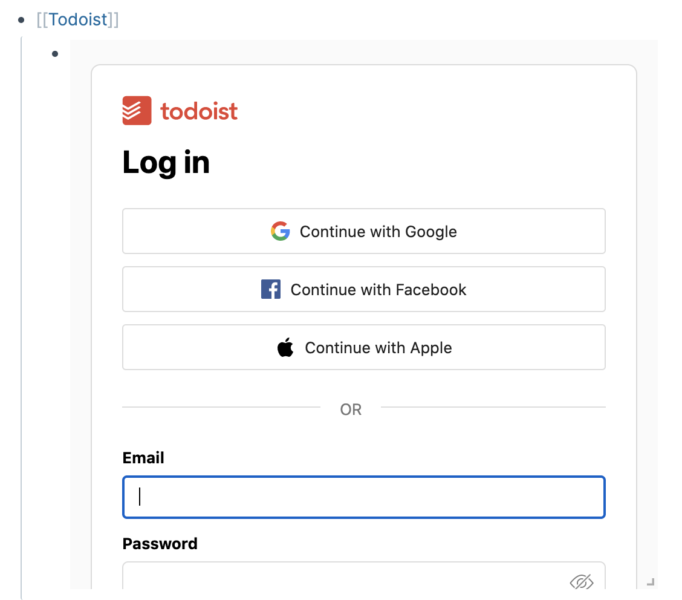

iFrame Embeds

One final tool that is quite powerful, though I don’t use a lot, is iFrame embeds. This structure won’t work on most websites because it requires they be set up a certain way. But when it does work you can embed another website right inside your Roam graph.

If you type this and then put the website you want to try and embed it will attempt to pull the site into a block on Roam. I’ll explain this more later on as well: {{iframe: https://website.com }}

Why Roam?

There are lots of tools out there that can help you become a better investor. There are a few that are unique to Roam. The biggest thing for me is building interconnected knowledge pieces. Being able to block reference to common investment frameworks and use them over and over again helps me better understand them. Being able to tag anything I read or any conversation I have to a specific company makes it a powerful node.

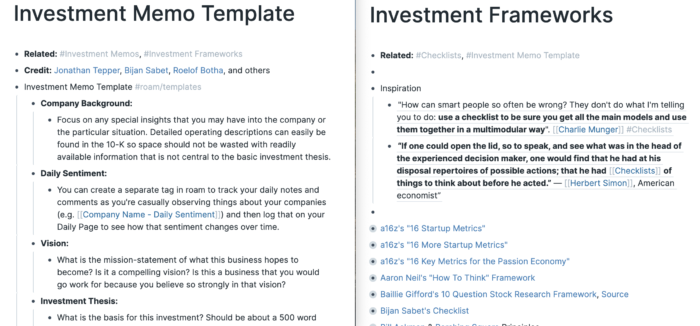

I wanted to share some resources I’ve made to help me research my investments consistently: (1) investment memo templates, and (2) investment frameworks.

You can download both of these collections in the Investing 101 2.0 Sandbox, a public Roam graph that I use for thinking in public (at the moment, it’s early days in building it out.) I’ll reference these resources a few times as part of my investment process.

The Investing Why

Before I get into the HOW of my investment research, I want to reflect on the WHY. If you’re on Twitter, or Reddit and have two thumbs attached to a keyboard, you’re probably hearing a lot (maybe too much) about retail traders like they’ve never been seen before. I have no take on the impact they may have on the financial system. But in the long view, I’m excited about the massive surge of people stepping into the role of investors.

Retail investors went from 10% to 20% of market volumes last year, adding over 1M new brokerage accounts. My fear is the false sense of security and confidence that can come from operating in an unprecedented bull market. I don’t want to see 1M+ YOLO day-traders. Instead I want to see 1M+ thoughtful individuals getting engaged in the greatest period of democratized wealth creation ever — with more companies going public, technology markets being bigger than anyone ever predicted, rates of innovation increasing drastically, and globalization giving people access to bigger and bigger consumer markets.

There will always be people looking for ‘get rich quick’ opportunities, but my hope is this resource will find its way to folks who want to become informed investors.

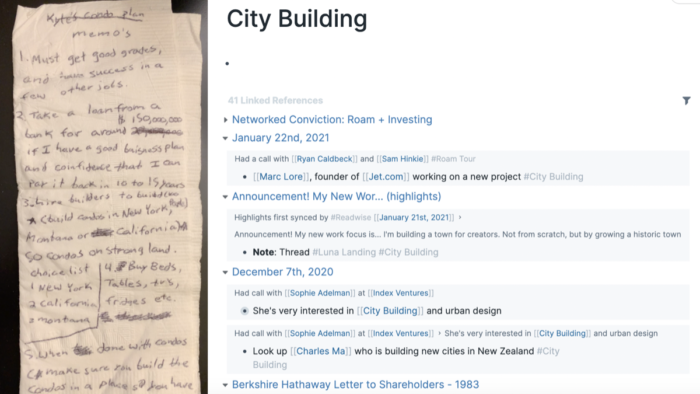

Portfolio Ideas

I have always had what I’ve called “portfolio ideas.” These are big-picture ideas that I collect lists of articles, concepts, and experts around. When I was 11, I wrote a business plan on a napkin for building a city starting with a bunch of condos. Now in Roam I have a [[City Building]] page. That is a portfolio idea. If you’re a curious person, I guarantee you have portfolio ideas. The act of just acknowledging those ideas is powerful.

Roam has become a compounding multiplier on my portfolio ideas because now I’m not just mentally amassing ideas. I’m building a graph of them. Every time I read an article, see a tweet, have a conversation, or have a book recommended I can simply add #[[City Building]] and I automatically add it to my feed for that idea. Being an investor is largely about having portfolio ideas and then finding ways to invest behind them.

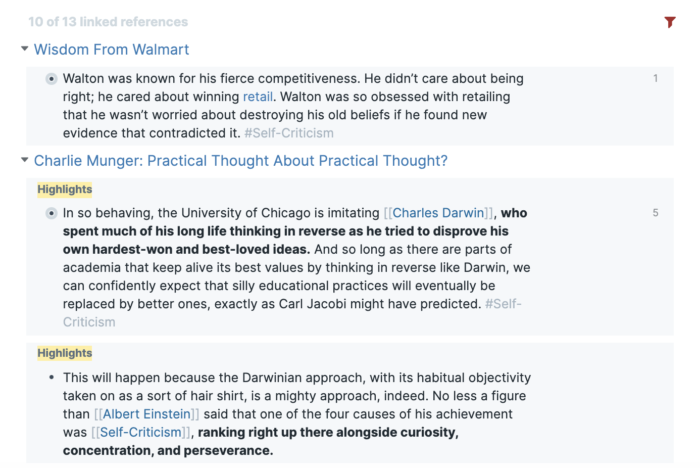

Self-Criticism

If you only ever had good ideas, you’d be set for life and I’d be first in line to give you all my money. But we all know Elon Musk is the only one with exclusively good ideas. The rest of us need some help sifting the good from the bad.

Over the years I’ve collected a number of quotes that help me understand the need for criticizing my own ideas (all tagged with #[[Self-Criticism]]):

“Charles Darwin…spent much of his long life thinking in reverse as he tried to disprove his own hardest-won and best-loved ideas.” (Charlie Munger)

“Sam Walton was so obsessed with retailing that he wasn’t worried about destroying his old beliefs if he found new evidence that contradicted it.” (David Perell)

“It’s not bringing in the new ideas that’s so hard. It’s getting rid of the old ones.” (John Maynard Keynes)

“I feel that I’m not entitled to have an opinion unless I can state the arguments against my position better than the people who are in opposition.” (Charlie Munger)

“One mark of a great mind is the willingness to change it.” (Walter Isaacson)

”Einstein said it better, attributing his mental success to “curiosity, concentration, perseverance, and self-criticism.” By self-criticism, he meant becoming good at destroying your own best-loved and hardest-won ideas. If you can get really good at destroying your own wrong ideas, that is a great gift.” (Charlie Munger)

The point of my research is to reflect on the portfolio ideas that I have and then push myself to criticize them. Any idea that can’t stand up to scrutiny wasn’t a good idea in the first place. The power of investing is being able to get behind those ideas you have with conviction you’ve earned through doing the work. “Take one simple idea, and take it seriously.” (Charlie Munger)

The Investing How

Creating a Company Page in Roam

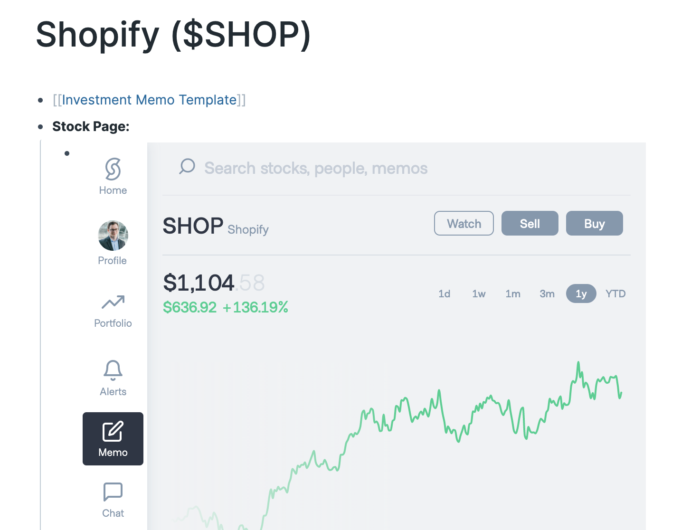

My investment process starts with a company page. Every company has a dedicated page where I try to build a central hub of everything I know about the company. For public companies I usually use this convention: [[Company Name ($TICKER)]] to help me keep them separate from private companies that I also track.

When I set up a new company page I follow the same process

- Set up the [[Company Name ($TICKER)]] page (for private companies I just leave off the ticker)

- Open the page and type [[Investment Memo Template]]

- Shift + click the memo template page so that it opens up in the sidebar

- Highlight the main item blocks (e.g. Company Background, Daily Sentiment, etc.)

- Hold down Command, click and drag on the top block (right on the bullet point) and drag the selection over to the main company page (in Windows, you should use Ctrl instead of Command). This creates block references to all of my key memo areas

- You could also use roam/templates in this situation but I like having block references so I can see a list of everywhere that key area has been addressed in a drop down. More on this later.

Now that I have my company page set up, this will be my home base for all things related to this company. Most of my research notes from articles and conversations will end up here as will any thoughts I note down on the company.

The two things that I might create / pull into the company page beyond this outline are (1) the daily sentiment tracker, and (2) relevant investment frameworks.

Daily Sentiment

I mentioned this briefly before. The great thing about the Daily Notes page is it allows you to track things with an automatic date stamp and lets you add commentary around a company quickly in a place you’re already probably spending a lot of time within Roam.

Personally, I prefer to do most of my writing, note taking, and analysis on a company within the company page itself rather than on my Daily Notes.

But there is value in being able to track how my sentiment about a company evolves over time. That’s why I use the [[Company Name – Daily Sentiment]] concept. As I casually make observations about a company, I record them on my Daily Notes page (e.g. reviewing Twitter or Feedly for random tidbits about companies I like.) Then, I can open up the Daily Sentiment tracker in the sidebar to make observations about what I’m noticing over periods of time.

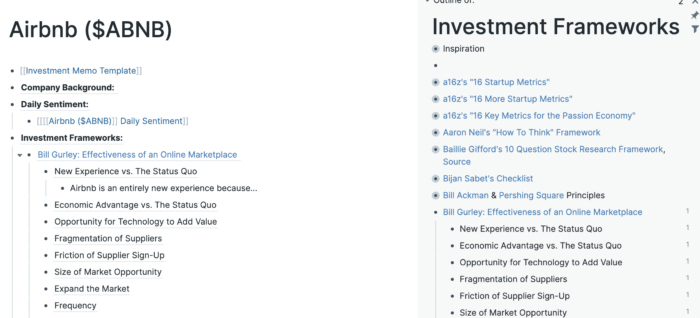

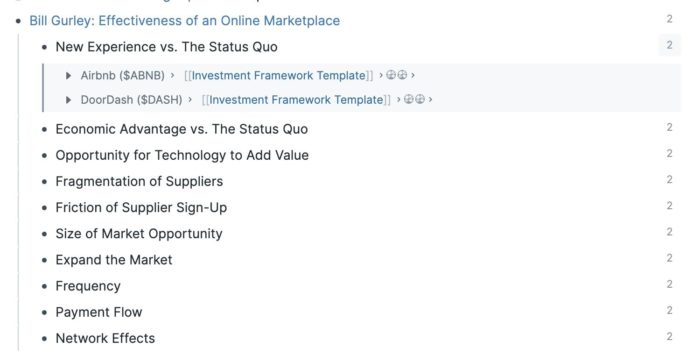

Investment Frameworks

The other piece of outside reference that I’ll pull into a company page comes from my [[Investment Frameworks]] page in the Investing 101 2.0 Sandbox. This is my growing collection of formatted frameworks and checklists from different investors.

“How can smart people so often be wrong? They don’t do what I’m telling you to do: use a checklist to be sure you get all the main models and use them together in a multimodular way” (Charlie Munger).

The purpose of a checklist is not to make you a dumb algorithm just checking boxes. We all have intense psychological tendencies that make it hard to evaluate all the right criteria, especially when we think we already know the answer.

“Man’s imperfect, limited-capacity brain easily drifts into working with what’s easily available to it. And the brain can’t use what it can’t remember or what it is blocked from recognizing because it is heavily influenced by one or more psychological tendencies bearing strongly on it. And so the mind overweighs what is easily available and thus displays Availability-Misweighing Tendency. The main antidote to miscues from Availability-Misweighing Tendency often involve procedures, including use of checklists, which are almost always helpful.” (Charlie Munger)

Roam is uniquely perfect for this kind of networked thought. You have a common repo of questions, frameworks, checklists, and categories. By easily being able to pop them open, apply them to your current research, and see where else they’ve been used effectively, you can become a powerhouse.

Information Ingestion

The top of the funnel for research is a sort of directed stumbling. My coverage of a company starts with googling things like “Company name + Breakdown” because that’s a common title for high level business introductions. Another unique way to do something is similar is to google “Company name + Substack” to try and find thoughtful analysis. Substack, if you’re not familiar, is a blogging platform that is popular among business and tech writers. So finding the best Substacks can often lead to the best analysis. From there I decide how I want to ingest.

Feedly

My biggest limitation is the amount of content I can reasonably ingest. As a result, I’ve had to be more selective about what content I consume. Because of that, I haven’t used Feedly as much lately. It has quite a bit of noise amidst some potential for signal. Feedly lets you subscribe to specific RSS feeds, which are usually harder to find for smaller companies. But, for coverage of larger or public companies, it can be a valuable way to get a sense of things like high-level product updates or press releases.

This small, press release-esque type of content is exactly the kind of thing that would go into my [[Company Name – Daily Sentiment]] tracker on my daily page. Spending less time in Feedly means that a lot of those observations now come from Twitter.

Eloquent

If I read an article that is relevant for a company but isn’t overwhelmingly interesting, I might jot down a few notes under [[Company Name – Daily Sentiment]] in my Daily Note. But, when I find something I really enjoy, I’ll use Eloquent.

Eloquent is a phenomenal ‘made-for-Roam’ note-taking tool that you can pop up right in your browser. You can use short commands like “/title” and “/url” to pull in the metadata for an article you’re reading. Then you can click the highlighter button on the bottom left of the panel and anything you highlight in the article will automatically get pulled into your notes. Within the panel, you can double bracket, bold, highlight, etc. I particularly love using this with company filings, earnings call transcripts, and expert network transcripts like Tegus.

The one thing I haven’t found as good a way to ingest into Roam is PDFs. There are some early projects that I’m really excited about.

When I finish reading a particularly good piece of analysis, I’ll copy and paste my notes from Eloquent into the “Resources” section of my company page. I might throw in “/today” next to the article to remind myself what day I read it. This is by the far the most common way I consume high quality analysis.

Some articles and books merit their own dedicated page rather than a section on the company page. I’ll also use a less organized version of Tiago Forte’s ‘Progressive Summarization’ technique. As I read and take notes, I’ll use Eloquent to pull in what I like. Then after I’ve got all my highlights in one place I’ll review them with a “Key Takeaways” section at the top of my notes, summarizing ideas in my own words.

For example, as part of developing a thesis on [[Disney ($DIS)]], I recently read a book about Walt Disney’s city building vision. You can see my key takeaways section at the top.

The Power of Readwise

https://www.youtube.com/watch?v=w8tM1cu0Agk

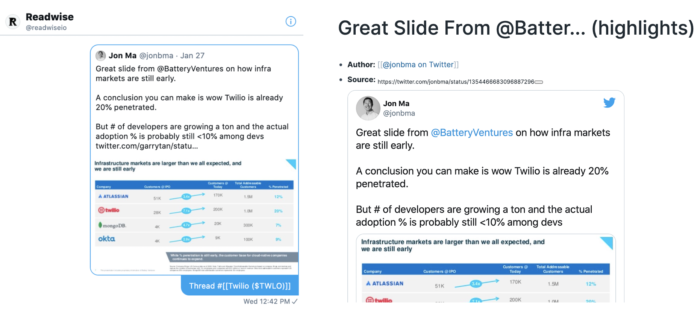

One of the most phenomenal knowledge tools in my Roam stack is Readwise. I can connect Readwise to all the places I read things (Kindle, Instapaper, Twitter) and then import my highlights directly to Roam with pre-established metadata (e.g. pull in the author’s name, add specific tags for different kinds of content, etc.)

Kindle

The two most common things I’ll use this for is importing book notes from Kindle and importing tweets that I want to save. The screenshot above for the book “Walt Disney and the Promise of Progress City” is the end result once I’ve read a book in Kindle, highlighted interesting passages, and reviewed my notes to summarize my key takeaways.

As it relates to my investment research, I can include a link to the book in my company page, and block reference specific passages right into my company page if it’s super relevant to my thesis.

Side note for those of you that do the majority of your reading in physical books. Readwise has a phenomenal OCR capture tool where you can take pictures of your highlights in physical books and save them as highlights that similarly import right into Roam.

Instapaper

You can also read articles in Instapaper and Readwise will automatically import your highlights into Roam. I do this occasionally for articles I’m only passively interested in, but when it’s an article I really want to digest for a specific investment thesis, I prefer Eloquent + Roam. I’d like to get better at using Instapaper more consistently.

I would pay $15+ a month for Readwise even if all I got was the direct Twitter to Readwise to Roam import. When I see a tweet that I like or that is relevant to an idea I have in Roam, or a stock I’m tracking, I can just DM it to @readwiseio, type the word “Thread” so that it saves the text of the tweet, and whatever tag I want to appear in Roam.

Stock Tracking

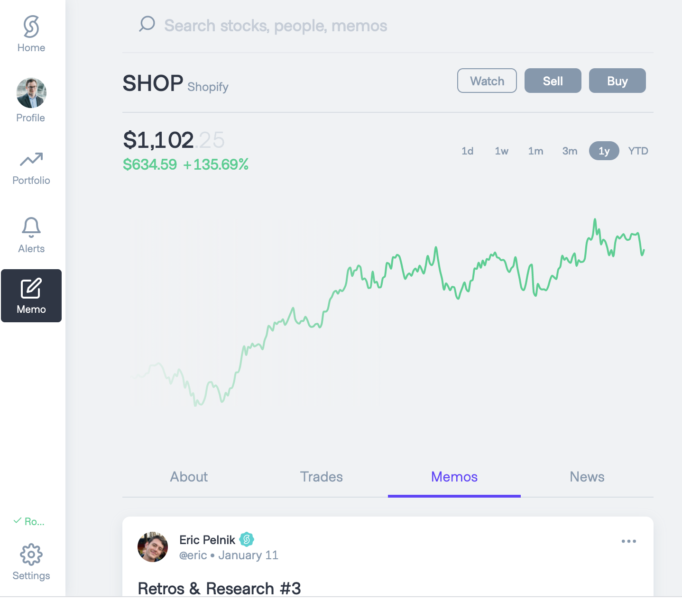

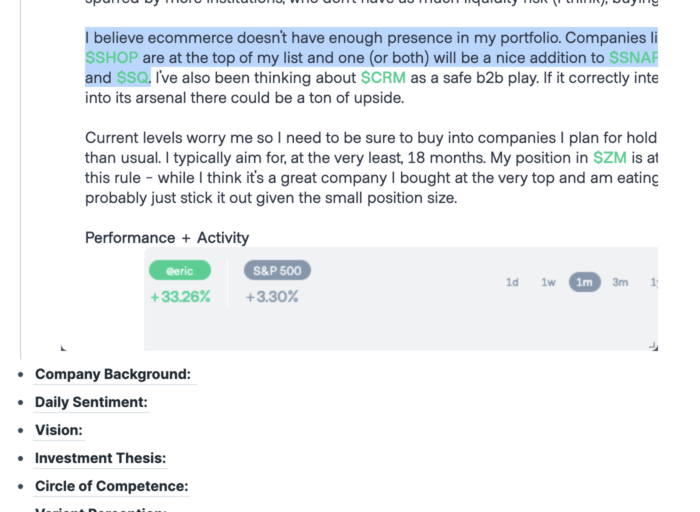

Some of the best information about a business lives in niche communities online. You can find these on Twitter, Reddit, or elsewhere, but my community of choice is Commonstock.

The most powerful thing about Commonstock is the emphasis on connecting high quality analysis to specific stocks. When I start covering a company, one of the places I start is on Commonstock. I’ll review the leaderboard for a particular stock and see if those users have published any memos.

I don’t need super robust information on a stock, but I like to have everything in one place which is why Commonstock is so relevant to Roam. One of the things I love is using an iFrame embed to put a stock page from Commonstock as part of my company page.

From there I can even pop open different memos directly in the embedded window and take notes right in my company page.

There are certainly more sophisticated data tracking tools for stocks but, for someone like me who is mostly managing long-hold thesis-driven investments in public companies, this works great for me.

Creating a Personal CRM

Even outside of specific company coverage, Roam is a phenomenal CRM for all parts of my life. For every call I have I tag the [[Name]] and [[Company]] of the person I talk with. I’ll try and tag them within relevant pages as well (e.g. [[Identity & Access Management]]. By doing that, when I go looking at different areas I’ll start to notice, “hey this person has come up a lot in regards to XYZ.” I can then drill into that person’s page in Roam and see where else we’ve had conversations that might be relevant for me. This has become the way I’ve started identifying the folks who are category specialists within my network. There are some early projects out there like Roam CRM building out features to automatically enrich contact information.

Learning in Public

Recently I had a call with a successful public market investor. The topic of “learning in public” came up. He asked me a first-principles question that I should think about more often: “What is the benefit of learning in public?” Big hedge funds traffic in ideas and they get paid for having differentiated perspectives. Learning in public could be seen as antithetical to the traditional investing model. But the world is opening up. Some of the best brainstorms aren’t happening in deal meetings but on Twitter. The best analysis isn’t locked behind equity research paywalls, it’s on Substack.

Think about it this way. As Tiago Forte puts it: “The scarcity mindset of the past led us to hide and protect our ideas. But today, power and influence come from sharing our ideas, not from keeping them secret.” And why does sharing ideas drive power and influence? The more you’re willing to put out ideas, whether right or wrong, the more likely you are to start accumulating right answers.

>>”The best way to get the right answer on the internet is not to ask a question; it’s to post the wrong answer.” (Ward Cunningham)

When you start learning in public, you’ll start looking for a medium of communication. For some, it’s as casual as posting on Twitter. For others, it’s as organized as creating a Substack newsletter. But there is a spectrum of where my ideas live — going from my raw Roam graph to my “digital garden” to finalized published writings. The vast majority of my ideas are in my private Roam graph. But there are a lot of different ways to share ideas.

Digital Gardens

The idea of a digital garden is an emerging but powerful one. Maggie Appleton describes them as “collections of evolving ideas that aren’t strictly organised by their publication date. They’re inherently exploratory – notes are linked through contextual associations. They aren’t refined or complete – notes are published as half-finished thoughts that will grow and evolve over time.”

I’ve started using a combination of Notion + Super.so for my personal digital garden and the Investing 101 2.0 Wiki. Rather than containing the raw intellectual thinking that goes on in my Roam graph, my digital garden is starting to become a place where my slightly developed ideas go to get exposure to the light of day. I’m a huge fan of this setup because I don’t have much interest in learning new ways of building websites, so the simplicity of typing something into a Notion page and having it automatically populate on my site is really compelling.

There are some early projects like RoamanPub and Roam.garden working on allowing you to turn parts of your Roam graph into publicly available sites. The project is still in alpha testing so it’s very simple right now, but the idea is quite powerful. I’ve been playing around with it a bit. There are other tools that are more focused on paywalls or posting tweets directly from Roam.

Commonstock

Powerful communities have been built up around investors’ ideas — from SumZero to SeekingAlpha. Each is built with different end goals in mind. My preferred community of investors is on Commonstock. On a call I had with a public investor, he focused on the concept of tying ideas to specific stocks and being able to find some great thinking: “I should use Commonstock to hire analysts. I can already see their performance!”

I continue to be surprised by the level of thinking I find there. I recently stumbled on a memo (only accessible if you have a Commonstock account) from Steven Xu about Lyft and loved it. That kind of surprise is what makes Commonstock a big part of my investing stack. I want to engage with these people because they largely seem to be focused on finding the best ideas rather than the hottest new stock tip. Publishing memos there feels like a phenomenal way to learn in public.

Public Roam Graphs

When I dream of Roam, I’m most excited about their potential to build a global knowledge graph. Being able to take people’s ideas and weave them together is transformational, but we’re still in the early innings.

There are some really interesting projects that have tested the collaborative nature of Roam. The company holds book clubs in shared Roam graphs, and we’re starting to see others build similar things. Some people are building public Roam graphs for their own thinking or projects like the Investing 101 2.0 Sandbox. Another example is Chris Harvey’s “Venture Capital Fund Law” Roam graph. This is just the beginning.

There are really thoughtful business analysts who spend time creating unique perspectives in public. Folks like Jake Singer with The Flywheel and Mostly Borrowed Ideas with MBI Deep Dives. I would love to see those types of thinkers building some of their raw ‘in-progress’ ideas into Roam graphs. Better yet, let’s get some of these thinkers together in a collaborative Roam graph and start interweaving different ideas.

The most significant ideas I reflect on here are (1) the power of niche communities, and (2) building sources of contextual information. Groups of motivated and intelligent people can produce earth-shattering work and something like Roam can help bring their ideas together. Niche communities of knowledge get built around specific companies. How can we make those knowledge networks more accessible? When those ideas become contextual, you’re not just answering simple questions like “what does this business do?” You’re going a layer deeper into answering the question “therefore, what?”

Therefore, What?

Investing 101 2.0 will be my approach to continue exploring the ways that investing is being revolutionized whether through data in investing, bifurcation of investment firms, solo capitalists, equity crowdfunding, diversity & inclusion, democratized secondary transactions, or triple-bottom-line investing.

If you’re interested in following along you can follow me on Twitter @kwharrison13 or sign up on Substack. The two resources to bookmark that I’ll update most frequently are the Investing 101 2.0 Sandbox (for research resources like the Investment Framework Collection) and the Investing 101 2.0 Wiki as a work-in-progress resource for a “general education” in all types of investing.

*Huge thanks to Francis Miller and Terese Brewster at RoamBrain for helping to edit this article, to Chris Harvey, Sam Hinkie, and Ryan Caldbeck for reading early drafts, and to tons of Roam nerds for sitting down with me to talk about how they use Roam.

**I am a personal investor in Roam Research